My Story

My peers were clapping. I had just landed an annualized $40,000 revenue account for my firm and the deal was signed and closed. The 30 other professionals shoehorned into the basement conference room would have all killed for that type of deal. I wasn’t smiling. The win, the deal, did nothing for me. It was just a ton of work, and after I split the revenue with my company and paid my taxes it would net me $500 a month. I didn’t like the work I was doing. Worse yet, the deal had taken me two years to close.

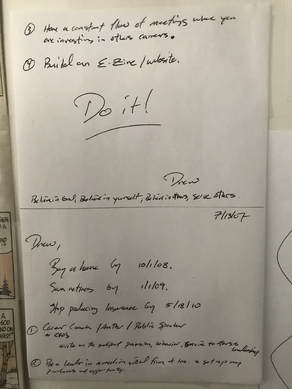

I went home and had dinner with my young family that included a hard working wife and two children under the ages of four, and I wrote myself a letter. It said get out of the insurance business by 2010. It was July 13, 2007.

I left the insurance business on Feb 11, 2013 and started Banyan Tree Strategies with three clients and the dream that we could help people grow their businesses.

In the time between July 13, 2007 and today the children have grown, my wife has left her commercial real estate business to help run our company, and I have averaged over 150 business meetings or meals a year. When I was a commercial insurance broker we worked with business owners to think through what could be done to protect the company’s balance sheet and to mitigate or transfer the risk to a 3rd party (buying insurance).

Since Feb 11, 2013 our conversations have shifted. Instead of listening for what might break or go wrong, we focus on what can improve, and how we can develop a plan to achieve a big scary goal. We meet with people and ask: what can you build or make that is amazing? What contribution can you make that is remarkable? Let’s write it down and then start working on the steps to get there.

Conversations with a business owner often lead to the idea of doubling the business in five years, which equates to a 15% compounded return. Most of our clients are either professional services firms, like asset managers and insurance brokers, or software companies who are selling a subscription or what is commonly referred to as SAAS. Doubling the company in five years makes most business owners a little nervous. They don’t want to fail. They don’t want to declare a goal and then not obtain it. However, they really do want to grow.

How to grow and the key actions and lever points to achieve that growth are covered here on our website. Four years and hundreds of meetings later we have chronicled the questions and answers from those meetings and client engagements for your ready reference.

My peers were clapping. I had just landed an annualized $40,000 revenue account for my firm and the deal was signed and closed. The 30 other professionals shoehorned into the basement conference room would have all killed for that type of deal. I wasn’t smiling. The win, the deal, did nothing for me. It was just a ton of work, and after I split the revenue with my company and paid my taxes it would net me $500 a month. I didn’t like the work I was doing. Worse yet, the deal had taken me two years to close.

I went home and had dinner with my young family that included a hard working wife and two children under the ages of four, and I wrote myself a letter. It said get out of the insurance business by 2010. It was July 13, 2007.

I left the insurance business on Feb 11, 2013 and started Banyan Tree Strategies with three clients and the dream that we could help people grow their businesses.

In the time between July 13, 2007 and today the children have grown, my wife has left her commercial real estate business to help run our company, and I have averaged over 150 business meetings or meals a year. When I was a commercial insurance broker we worked with business owners to think through what could be done to protect the company’s balance sheet and to mitigate or transfer the risk to a 3rd party (buying insurance).

Since Feb 11, 2013 our conversations have shifted. Instead of listening for what might break or go wrong, we focus on what can improve, and how we can develop a plan to achieve a big scary goal. We meet with people and ask: what can you build or make that is amazing? What contribution can you make that is remarkable? Let’s write it down and then start working on the steps to get there.

Conversations with a business owner often lead to the idea of doubling the business in five years, which equates to a 15% compounded return. Most of our clients are either professional services firms, like asset managers and insurance brokers, or software companies who are selling a subscription or what is commonly referred to as SAAS. Doubling the company in five years makes most business owners a little nervous. They don’t want to fail. They don’t want to declare a goal and then not obtain it. However, they really do want to grow.

How to grow and the key actions and lever points to achieve that growth are covered here on our website. Four years and hundreds of meetings later we have chronicled the questions and answers from those meetings and client engagements for your ready reference.